In December 2017, President Trump signed the Tax Cuts and Jobs Act (TCJA), H.R. 1, into law. The changes introduced with this reform not only will have a tax impact on individuals and businesses but also will force multinational organizations to transform their global compensation and mobility policies and structures. These companies may need to take another look at their current assignments and reassess the costs, update budgets, and potentially think about an exit strategy.

Let’s take a closer look at H.R. 1 and how it relates to global mobility considerations.

Tax rates

One of the major changes under the new legislation is the implementation of lower tax rates, beginning with tax year 2018.

Modification of the tax rates will have an impact on the projected cost of current assignments. Depending on the combination of jurisdictions — high-tax or low-tax countries — this change may increase or decrease the costs of your mobility programs. To better plan and budget for future costs of assignments, multinational employers should consider re-evaluating tax costs determined under the previous tax law.

Additionally, lower tax rates, an increased exemption for the alternative minimum tax, and other changes will have an impact on the calculation of the hypothetical tax and determination of the overall cost of assignment. We recommend updating your hypothetical tax calculations to adjust the amount deducted from employees toward their share of the tax liability.

Standard and itemized deductions and personal exemptions

Under the new legislation, individual taxpayers will be eligible for an increased standard deduction. However, personal exemptions for taxpayers and qualified dependents will be repealed for taxable years starting in 2018. The standard deduction will be increased to $12,000 for single filers, $18,000 for heads of households, and $24,000 for married filers, with no phase-out due to income level.

With an increase in the standard deduction, H.R. 1 implemented multiple modifications to eligible itemized deductions, resulting in less benefit for many taxpayers. Among the most common deductions that will be reduced are those for state and local income tax, property tax, and/or sales tax. The new law limits the deduction to $10,000 of the combined state and local income tax, sales, and U.S. property tax. Additionally, the mortgage interest deduction will be limited to interest on up to $750,000 of indebtedness on a qualified residence, i.e. primary residence and a second home.

The decrease in the state income tax deduction will primarily impact individuals in high-tax states. Also, individuals who own property in a foreign country will no longer be able to deduct the property taxes. Individuals may find it's more beneficial to claim a standard deduction rather than itemize, and if they do still itemize, deductions may not be as significant as in the past.

In terms of globally mobile employees, these changes will affect the calculations of assignment costs as well as the calculations of hypothetical tax liability for tax-equalized individuals. Companies should consider updating these calculations in order to accurately budget for assignment costs. Tax equalization policies that have specific provisions with respect to standard and/or itemized deductions may also need to be updated.

It's also important to note that the repeal of personal exemptions will have a significant impact on nonresident filers and will trigger additional tax costs (and tax return preparation costs) to companies with a high number of employees on assignment in the United States. Nonresidents are not eligible to claim the standard deduction, only limited itemized deductions, and the elimination of personal exemptions — absent tax treaty relief — may effectively subject their total U.S.-source income to tax in the United States.

Child tax credit

The child tax credit, previously limited to $1,000 per child and phased out with adjusted gross income (AGI) above $110,000, will now be expanded to $2,000 per child and phased out with an AGI above $400,000. The credit will also be broken down into refundable and nonrefundable portions.

One of the limitations of this new provision is a requirement for children to have a Social Security number in order for the taxpayer to be eligible for the credit. In the case of inbound taxpayers, dependent children are typically only eligible for ITINs, which in turn would make them ineligible for the child tax credit. However, to reduce the burden of this provision on foreign citizens with otherwise qualifying children, the regulations allow for a nonrefundable credit of $500, that was originally allowed for nonchild dependents. Companies should reassess the costs projected at the start of assignments and determine if the benefits of obtaining ITINs for assignees’ dependent children outweigh the costs of the applications.

Compensation

Payroll

Since tax rates and brackets have changed and personal exemptions were repealed, companies will need to revise their tax withholding calculations. In January 2018, the IRS released Notice 1036, which updates the income tax withholding tables for tax year 2018. Employers should begin using the 2018 withholding tables as soon as possible, but not later than Feb. 15, 2018.

The new withholding tables are designed to work with the current Form W-4 that employees have already filed with their employers, so no action from employees is required at this point.

The IRS is also working on revising Form W-4. The form and the revised calculator will reflect additional changes in the new law, such as changes in available itemized deductions, increases in the child tax credit, the new dependent credit, and the repeal of dependent exemptions.

Additionally, withholdings on supplemental wages under $1 million should be deducted at a flat 22 percent rate. A flat 37 percent rate applies to supplemental wages above $1 million.

Moving expenses and fringe benefits

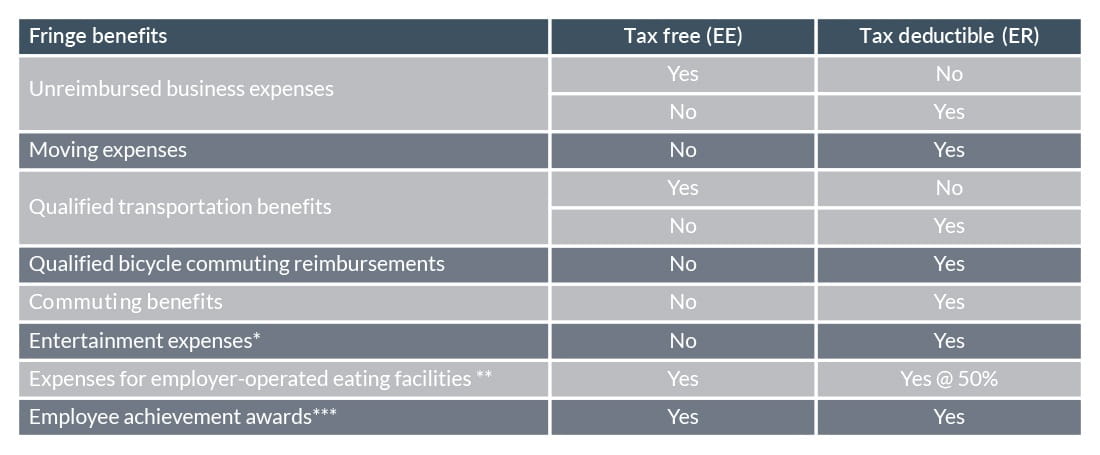

Repeal of the exclusion for qualified moving expenses will impact the determination of taxable income for U.S. purposes since reimbursement for certain qualified moving expenses will now become taxable. The act also clarifies the definition of “tangible personal property” for the purpose of determining a deduction for the company for employee achievement awards. Awards that qualify for a deduction could also then be excluded from employees' taxable gross income.

As defined, tangible personal property does not include cash, cash equivalents, gift cards, gift coupons, cash-based certificates, vacations, meals, lodging, tickets to sporting events, stocks, bonds, or securities. Deductions for certain other benefits, such as entertainment and recreation, meals, club dues, and transportation fringe and commuting expenses will be limited or repealed.

The table below summarizes the tax treatment of fringe benefits from the employee and employer point of view:

* Unless reimbursed under the accountable plan rules

** Nondeductible after 12/31/2025

*** Dollar/conditions limitation and award needs to be in form of tangible personal property, as defined by code

Companies should now look at their compensation reporting processes, and make sure pay codes are updated to reflect proper tax treatment.

This is also a good time to review relocation and tax equalization policies. Since certain expenses that previously had to be structured on a reimbursement basis can now be paid in the form of allowances, additional planning opportunities may exist. Companies may now have more options to structure their policies in a way that would provide greater flexibility and a lower rate of exceptions. Consideration also should be given to adjusting the level of benefits provided and clarifying whether those components are tax equalized or not.

Excessive employee remuneration

The definition of “covered employees” under the code Section 162(m) was expanded to include not only the chief executive officer but also the chief financial officer and the three most highly compensated officers.

The exception for the corporate compensation deduction for commissions and performance-based compensation also was eliminated. And, with respect to exempt organizations, an excise tax of 21 percent (paid by the employer) is imposed on compensation in excess of $1 million paid to covered employees.

Companies should review the structure of the rewards program offered to employees to determine if any of the transition rules apply.

In conclusion

It's important for multinational companies to carefully consider changes resulting from the new tax legislation and the impact on global mobility strategy, policies, compensation, and budgets. You may want to consider updating assignment cost projections to accurately reflect your future costs under the new legislation. With that, you’ll be better positioned to optimize your global strategy and determine next steps.