Hospitals and health systems are seeing operating margins stabilize. Yet many healthcare organizations struggle to reclaim lost margins, and rising costs are poised to outpace Medicare adjustments. These four strategies will help you build a path to financial stability.

As healthcare organizations rebound from the pandemic, many struggle to identify strategies and approaches to enhance financial efficiency and profitability. The extent of the challenges was heightened with the release of the Centers for Medicare and Medicaid Services (CMS) 2023-2032 National Health Expenditure (NHE) projections. In its report the CMS provided some predictions on U.S. national healthcare spending:

- The expected average annual growth in national health spending over the next decade is projected by Office of the Actuary to be 5.6%.

- Hospital annual spending is projected to grow at 5.7% — in line with NHE — while the average annual Medicare spending is projected to grow by 7.4% for 2023-2032.

- The Office of the Actuary projects that over this period the average annual growth in NHE will outpace the average annual growth in gross domestic product resulting in an increase in the health spending share of GDP from 17.3% in 2022 to 19.7% in 2032.

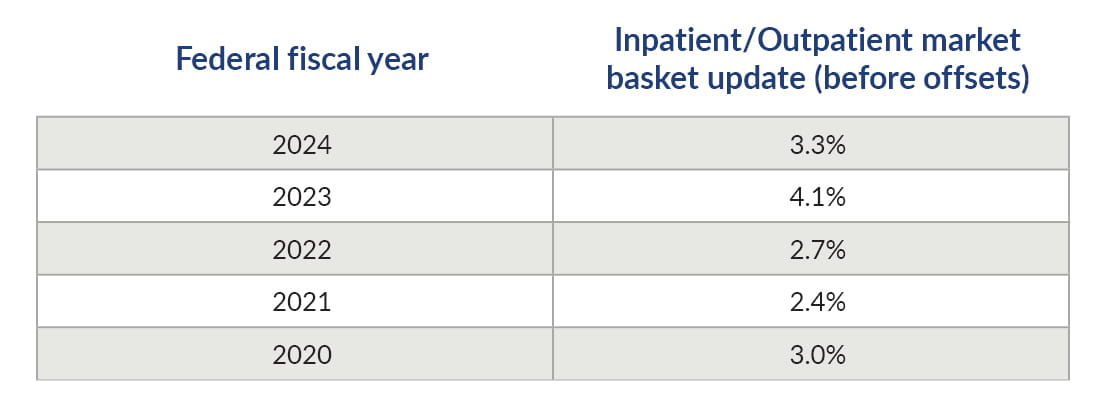

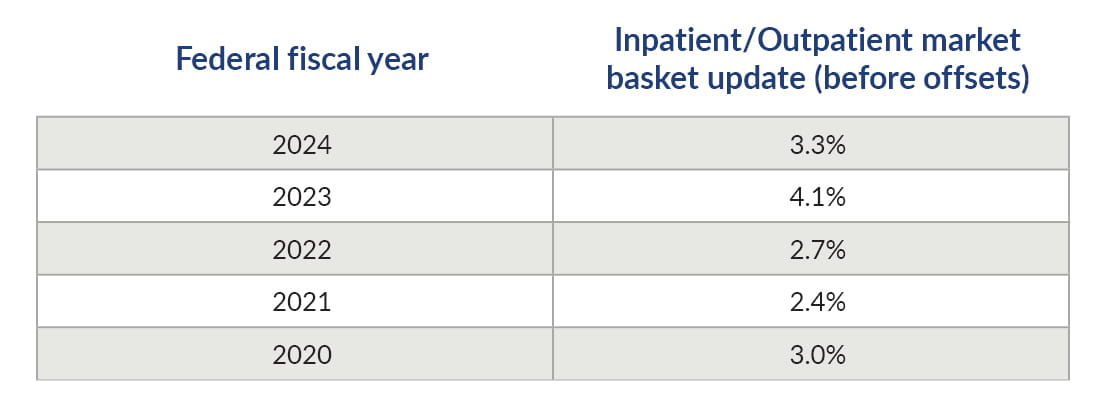

As we look back over the last several years — many of which have experienced inflationary growth well in excess of the totals projected above — we see that the market basket rate-of-increase hasn’t kept pace with inflationary pressures. In fact, the trended Medicare market basket updates over the past five years averages 3% — far below the projected 5.6% growth in expenditures.

Factoring in a growing Medicare population and a continued shift to managed Medicare and it’s all but certain healthcare organizations will continue to experience pressure on their margins. Healthcare Finance recently reported that 84% of health systems cite lower reimbursement from payers as a top cause of low operating margins. Medicaid redetermination is also expected to leave some patients uninsured who had previously been covered, and as these payments contract, charity and bad debts are likely to rise.

Given the reality that many hospitals and health systems rely on Medicare and Medicaid for a significant portion of their business, it’s more important than ever for healthcare organizations to be working to improve profitability.

Operating margin improvement strategies to consider

With labor, drug spend, and supply costs increasing at a faster pace than average inflation, what can organizations do to survive — and thrive? The answer is to be proactive with strategic financial planning around budgeting and forecasting, cost management, revenue enhancement, and improved financial outcomes. Focusing on the following four areas can bring maximum results.

1. Reimbursement optimization

Healthcare reimbursement is complex and challenging, and when inflationary pressures outpace annual reimbursement updates, it’s time to get strategic. Start by defining your ideal reimbursement structure — and then achieve it.

- Examine and validate your system-wide structure for eligible Medicare, Medicaid, and third-party payments and identify areas of potential reimbursement optimization.

- Take a proactive approach to minimizing the impacts of Medicaid redetermination protecting Medicare DSH payments and 340b eligibility.

- Use the CMS FFY2025 Wage Index Public Use files to balance staff retention and compensation and significantly impact health system revenue.

- Look for settlement items or revenue drivers within the cost report. Essential areas for cost report-related reimbursement optimization include bad debt, medical education, and disproportionate share.

2. Cost, productivity, and loss mitigation

Diligent financial operations often require a thoughtful approach to optimizing the financial health of complex organizations. As your organization grows and works to achieve optimal financial performance balanced with quality patient care considerations should be given to:

- Conduct feasibility studies including market studies and demand analysis to test the viability and demand of structure changes, affiliations, or investments and asset acquisitions. Consider strategies such as informed decision making, risk mitigation, and strategic roadmaps to cover new service offerings, partnerships, or investments.

- Complete a thorough service line analysis for highcost specialty service lines. Validate that service lines are profitable and identify areas such as productivity, efficiency, and profitability to enhance performance.

- Find gaps in reserve models that could be depleting your reserves.

- Create a payment strategy for payor negotiations.

3. Value based care performance and optimization

Consider the operational, financial, and care transformation changes necessary to succeed in a value-based care environment. Areas for review include:

- Current value-based terms: Look for incentives that you may be missing.

- Consider an independent assessment of your current performance across value-based operations and reimbursement. The VBC change has significantly impacted the ambulatory environments, and the value of “outside eyes” is pivotal to helping them see opportunities to enhance these operations.

- Financial impact and effectiveness of current value-based payment models and incentive programs.

- Potential savings and revenue related to value-based improvements in your organization.

- Potential site of care shifts that may impact your organization. It’s also important to understand where you’re in readying for these shifts.

- Investments to improve patient outcomes and patient experiences.

Other factors to consider:

- A review of the quality of your technology and data analytics.

- Effectiveness of your change management strategies.

- Resource utilization, processes, and care coordination to reduce waste.

- Quality metrics that measure the effectiveness, efficiency, and overall quality of patient care.

- Alignment of incentives.

- Accuracy of risk coding to ensure appropriate reimbursement.

- Patient satisfaction and loyalty, leading to retention and long-term revenue stability.

4. Operations: Labor productivity benchmarking

High labor costs are a significant driver of margin pressure. Operations improvement is an area with many actionable areas of improvement as you seek to manage labor costs and strengthen healthcare margins.

- Labor productivity benchmarking: With up to 60% of expenses comprised of labor and staff benefits, this can be one of your largest controllable costs. Match your staffing levels to patient demand and measuring labor productivity improves cost control. A strong productivity analysis will show areas where your organization is paying more to accomplish the same amount of work. The answer may be to reduce headcount, but it also may be valuable to look at your process efficiency in major clinical workstreams.

- Clinical process optimization: Executing cost and revenue strategies to improve clinical efficiency can drive margin improvement and competitive differentiation. Two areas with the biggest impact on profitability are the emergency department (ED) and operating room (OR).

- ED point of entry: Focus on engaging your utilization review (UR) team before ED providers write an admission order to ensure proper patient classification. If a patient is admitted to inpatient status and only meets observation criteria, your team has wasted valuable time and your reimbursement will be significantly impacted. The rework required to get patients into the right status will show in a strong labor analysis.

- OR efficiency: Surgical services contribute significantly to your bottom line, often as much as 60-65% of your revenue. If your labor analysis shows that your OR is overstaffed, the better answer is to focus on increasing surgical volumes rather than reducing staff. Find roadblocks to efficiency and improve throughput in your OR facilities to maximize physician productivity and pull forward revenue from patients waiting for non-emergent surgeries.

If your organization lacks the tools or resources to pursue these strategies internally, consider bringing in an external partner with broad industry experience to assist with the analysis and give advice from a nonbiased perspective.

Taking control of healthcare costs

With expenses going up at roughly 6% a year and revenue increasing at 3%, it’s a “make or break” time for many healthcare organizations. If you haven’t fully recovered from pandemic-related disruptions, it’s critically important to work on operating margin stabilization now to ensure your current state doesn’t become the new normal. By focusing on strategic financial planning around reimbursement optimization, cost and productivity, value-based care, and operations improvement, you’ll see improved margins and faster financial recovery to guarantee your strategic position in the marketplace.