Have you considered buying a commercial building so you can start investing in real estate? Investors value commercial real estate for its attractive characteristics, such as capital preservation, income generation, and inflation hedging. Real estate assets also tend to have a low or negative correlation with other traditional asset classes (e.g., stocks and bonds).

Unlike securities and fixed income products, real estate investments are active investments. With a stock, you evaluate, buy, watch its progress, and sell at the right time. Your investment is in a constant, passive state of hold/sell analysis until it’s time to exit. Real estate investments are inherently different. After the purchase, the property must be properly managed and monitored or you risk eroding the value of the asset — and any ROI.

That’s where a real estate asset manager come in.

Asset manager vs. property manager: What is asset management?

Real estate asset managers play an important role for real estate investors.

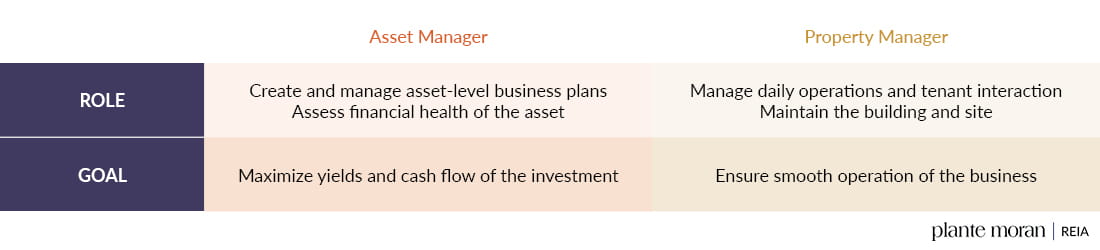

Don’t be confused, though — an asset manager is not the same as a property manager. They offer different experience, play different roles, and have different goals in providing services to the investor.

What does a property manager do? A property manager handles the tenant interactions, daily operations, and maintenance of a real estate asset. They’re there to run the shop, with the goal of keeping business operations running smoothly.

An asset manager, in its most basic duty, manages the activities necessary to improve the residual value or capital appreciation on the asset and maximize the cash flow it generates. In order to maximize yields and cash flow at the individual asset level, asset managers tailor solutions based on the specific dynamics and driving forces impacting each property.

Every asset has its own unique set of challenges, strengths, and risks. A real estate asset manager is uniquely positioned to help improve cash flow of real estate investments in three primary ways:

#1 Real estate asset managers help optimizing rental revenue

Optimizing rental and recovery income is paramount to maintaining and generating property cash flows. On the surface, it’s a simple concept: negotiate a favorable lease. However, commercial real estate leases are complex agreements with a variety of nuance and structures, requiring specialized knowledge to achieve strong, stable rental revenue. If executed properly, the lease can work in an investor’s favor to attract quality tenants, achieve better rental rates, and reduce vacancies in the center — all helping to maximize rental income for the asset and improve bottom line cash flows.

Real estate asset managers can assist with:

- Leasing – Asset managers source commercial tenants and conduct tenant interviews.

- Lease negotiation – Asset managers help structure lease agreements to attract quality, credit tenants, better ensuring the stability of rental income.

- Lease expirations – Asset managers anticipate upcoming vacancy by monitoring rent rolls, communicating directly with tenants, and monitoring tenant sales, so that the landlord can be proactive about filling an upcoming vacancy, instead of being reactive about filling a space that a tenant has recently vacated. Vacancies must be avoided to maintain strong cash flow, so asset managers help mitigate tenant rollover risk by strategically staggering lease expirations and negotiating lease extensions.

- Market research – Asset managers have a deep understanding of the rental market, including rental rates, tenant concessions, and vacancy rates at competing properties. All this data puts the landlord in the driver’s seat when it comes to structuring lease terms at market-benchmark levels.

#2 Real estate asset managers help minimize operating expenses

To complement strategies to maximize revenue, real estate asset managers also work to minimize expenses and owner maintenance for a property. For example, periodically shopping for the property’s service providers ensures competitive pricing. Also, structuring a lease to shift maintenance and capital expense responsibilities to the tenant or tenants shields the landlord from annual operating cost increases and costly capital repairs.

Moreover, an asset manager understands the operating expenses that can potentially cripple both an investor’s net operating income (NOI) and cash flow after debt service (CFADS). For example, real estate taxes are often one of the most substantial operating expenses and they can materially impact a landlord’s NOI and asset value. Experienced real estate asset managers have the resources and expertise to effectively appeal real estate tax increases, which can result in material savings for investors.

Real estate asset managers can assist with:

- Budgeting – Analyzing historical budget-to-actual variances allows asset managers to better understand what operating expenses are negatively impacting NOI and how to minimize them

- Lease negotiation – Asset managers structure lease agreements to limit an owner’s day-to-day responsibilities and common area maintenance expenses

- Efficient capital allocations – Asset managers can optimize cash flows by identifying capital expense items. This can be accomplished by either 1) making strategic capital improvements that reduce ongoing repairs, or 2) scheduling regular maintenance of capital items that will avoid costly replacement.

- Appealing real estate taxes – Asset managers will monitor assessment cycles and recommend tax appeals before a property re-assessment results in large real estate tax increases.

- Service provider RFPs – Managing the request for proposals (RFP) process for service providers ensures competitive pricing and reducing costs for needed services.

#3 Real estate asset managers monitor capital markets

Real estate asset managers monitor the capital markets in order to calculate the optimal way to construct the capital stack for a real estate acquisition to maximize risk-adjusted returns. Investors must also understand interest rate trends, debt and equity capital available, and transaction volume levels in the market to make sure their investments are capitalized appropriately to meet their investment expectations. Monitoring these constantly changing market dynamics can be challenging and time consuming. Asset managers work in these markets frequently, and conduct extensive market research to understand past real estate trends to better forecast upcoming real estate cycles. Understanding when it may be time to refinance existing debt by taking advantage of lower interest rates, can substantially improve an investor’s cash flow.

Asset managers search for debt capital across a variety sources, negotiate favorable loan terms based on the specific needs of the investor and financial performance of the asset, and assist with the loan documentation and closing process.

Real estate asset managers can assist with:

- Property-level financial projections – Asset managers use forecasting tools to understand the optimal timing for refinancing debt.

- Debt covenants and maturities – Asset managers perform the scheduled covenant testing required by commercial real estate lenders, monitor debt maturity schedules, and formulate a plan to maximize returns for properties with near-term debt maturities.

- Sourcing capital – Asset managers have a network to conduct broad market searches, uncovering competitive financing options to bring investors optimal loan terms.

- Efficient closing – Asset managers offer hands-on management through mortgage banking process to ensure timely close.

Conclusion

Asset managers act as the owner for the assets in the portfolios they oversee, seeking to maximize the cash flow and yield generated by those assets while maximizing asset value. They formulate and execute business plans to optimize income, lower operating expenses, and mitigate financing costs — thus improving the cash flow and yield of the asset.

Beyond the seemingly more obvious reasons to focus on improving NOI and cash flow (potential for greater distributions, property value appreciation, etc.), there are other reasons why investors should make NOI and cash flow a priority. Excess distributions or asset value appreciation allow investors to reinvest capital and grow their portfolios.

Real estate investing is complex; asset managers provide investors a great resource to navigate these complexities by offering accretion, stability, and risk mitigation for investors as they deploy capital into real estate assets and look to improve their returns. If you’re thinking about acquiring a commercial building for investment purposes, our real estate asset managers can help. Give us a call today.

In the meantime, if you liked this article, consider signing up for our newsletter to get more like it delivered right to your inbox.

Opinions expressed in this article are current as of the date of this article, and are subject to change at any time.

Plante Moran Realpoint Investment Advisors publishes this content to convey general information about our services. Investments and strategies mentioned herein may not be appropriate for you. Past performance does not guarantee future results. All investments include risk and have the potential for loss as well as gain. You should consult a representative from Plante Moran Realpoint Investment Advisors for advice regarding your own situation.